1120s Extension Due Date 2024. The deadline for 2024 is: Individuals who live in maine and massachusetts have until april 17, 2024, to file their 2023 form 1040 because april 15, 2024, is patriots’ day and april 16, 2024, is emancipation.

For calendar year corporations, the due date is march 15, 2024. Failure to file, will result in a penalty from $205 to $220 per month per.

A Corporation That Has Dissolved Must Generally File By The 15Th Day Of The 3Rd Month After The Date It Dissolved.

For individuals, that means you can still file for a tax extension right on april 15, 2024.

Estimated Tax, Paid Family And Medical Leave, And.

If you have employees, you need to file a wage and tax statement for each one with the.

You Will Later Receive An Electronic Acknowledgement That The Irs Has Accepted Your Electronically Filed Return.

Failure to file, will result in a penalty from $205 to $220 per month per.

Images References :

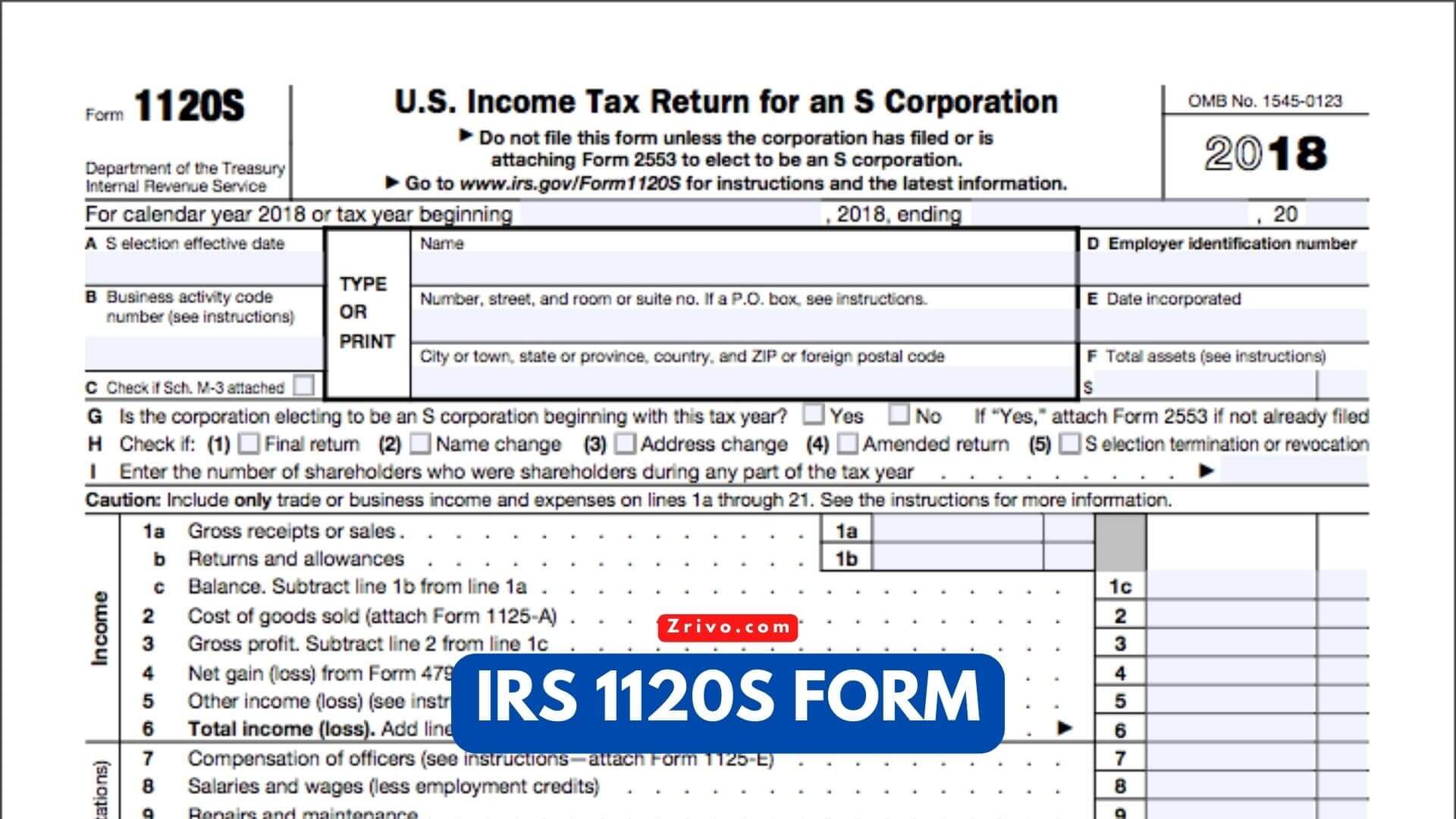

Source: www.zrivo.com

Source: www.zrivo.com

Form 1120S Extension 2023 2024, You can continue to use 2022 and 2021. You have right up until tax day to file for an extension.

Source: www.zrivo.com

Source: www.zrivo.com

Form 1120S Extension 2023 2024, For individuals, that means you can still file for a tax extension right on april 15, 2024. Form 7004 can be filed on or before march 15, 2024, to request an automatic extension.

Source: www.zrivo.com

Source: www.zrivo.com

IRS Form 1120S Instructions 2023 2024, You will later receive an electronic acknowledgement that the irs has accepted your electronically filed return. See below) good to know:

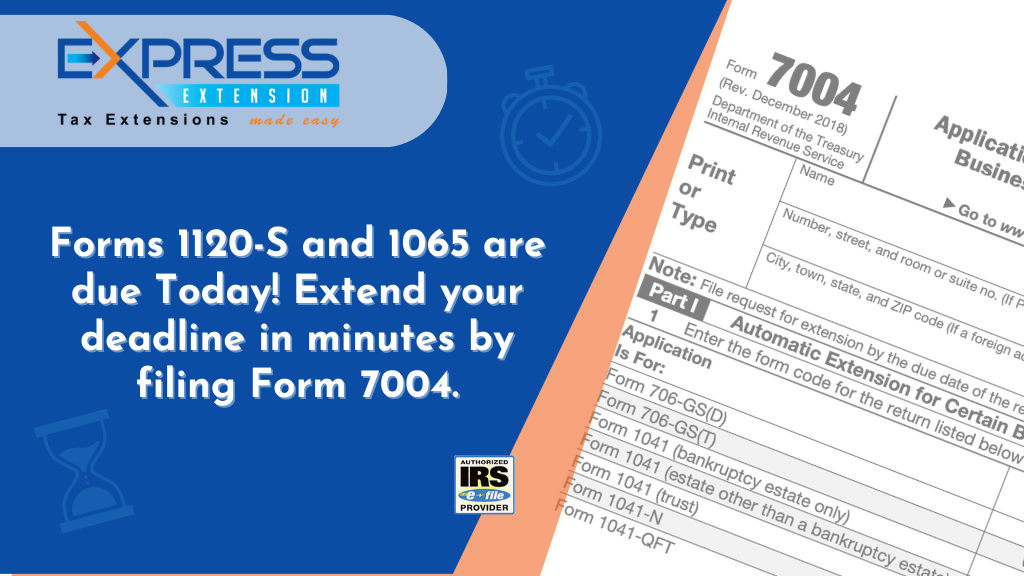

Source: blog.expressextension.com

Source: blog.expressextension.com

Forms 1120S and 1065 are due Today! Extend your deadline in minutes by, Estimated tax, paid family and medical leave, and. If you fail to request an extension or pay your taxes by the due date, you may incur additional penalties and interest.

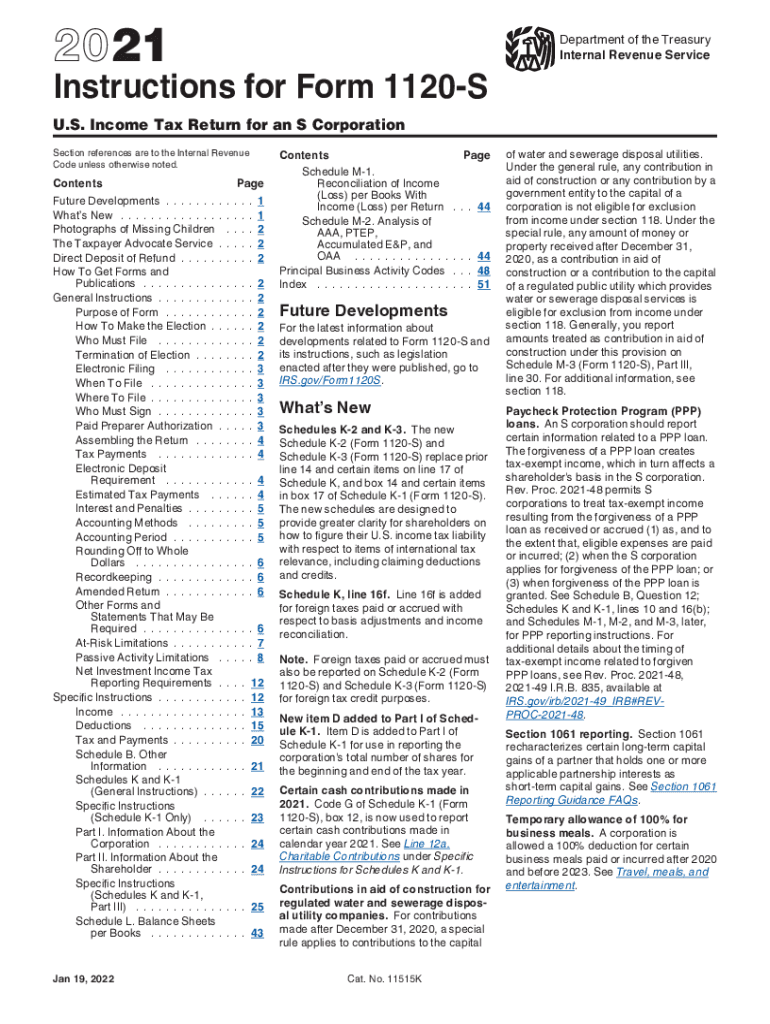

Source: headinghometodinner.org

Source: headinghometodinner.org

How To Complete Form 1120s S Corporation Tax Return Heading, A corporation that has dissolved must generally file by the 15th day of the 3rd month after the date it dissolved. This deadline applies to any individual or small business seeking to file their taxes with the irs.

Source: www.dochub.com

Source: www.dochub.com

Form 1120s instructions Fill out & sign online DocHub, Estimated tax, paid family and medical leave, and. A corporation that has dissolved must generally file by the 15th day of the 3rd month after the date it dissolved.

Source: www.zrivo.com

Source: www.zrivo.com

1120S Form 2023 2024, See below) good to know: You have right up until tax day to file for an extension.

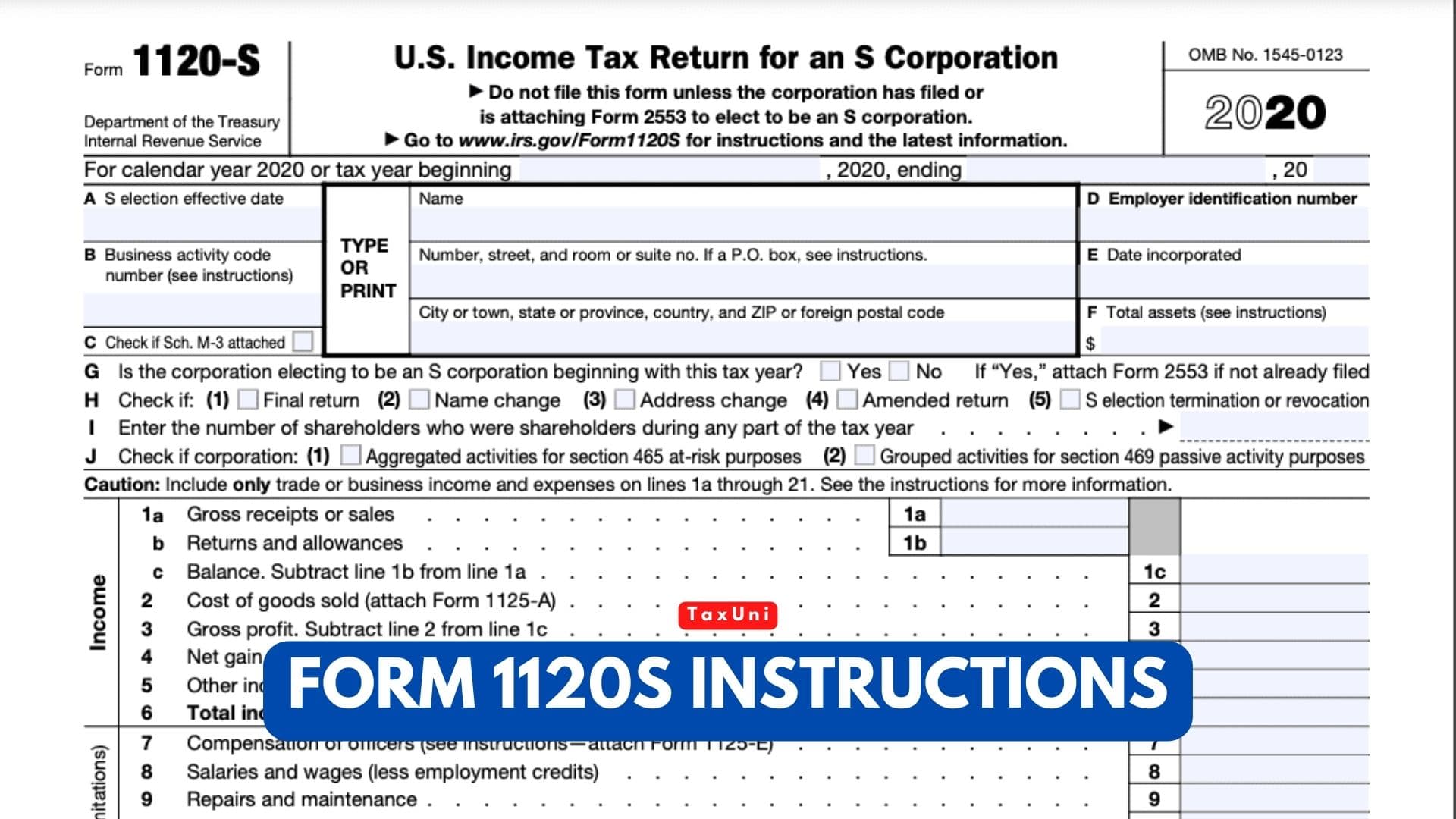

Source: www.taxuni.com

Source: www.taxuni.com

Form 1120S Instructions 2023 2024, When are 2024 tax extensions due? (1) by striking the date specified in section 106(3) and inserting “march 22, 2024”;

Source: ri-1120s-form.pdffiller.com

Source: ri-1120s-form.pdffiller.com

20222024 Form RI DoT RI1120S Fill Online, Printable, Fillable, Blank, You can continue to use 2022 and 2021. (1) by striking the date specified in section 106(3) and inserting “march 22, 2024”;

Source: www.zrivo.com

Source: www.zrivo.com

1120s Instructions 2023 2024, Form 7004 can be filed on or before march 15, 2024, to request an automatic extension. There's no final date for the transmission of electronic 1120 returns.

For 2024, S Corp Taxes Are Due On March 15, 2024.

(1) by striking the date specified in section 106(3) and inserting “march 22, 2024”;

The Due Date For An Extended.

The deadline for these tax filings is typically the 15th day of the third month following the end of the tax year.

When Are 2024 Tax Extensions Due?

This deadline applies to any individual or small business seeking to file their taxes with the irs.

Category: 2024